Kentucky State Tax Withholding Form 2024

Kentucky State Tax Withholding Form 2024. Please click here to see if you are required to report kentucky use. Kentucky’s 2024 withholding methods, which use a lower tax rate and a higher standard deduction than 2023, were released oct.

Kentucky state income tax tables in 2024. Electric vehicle power excise tax;

Corporation Income And Limited Liability Entity Tax;

Calculate your annual salary after tax using the online kentucky tax calculator, updated with the 2024 income tax rates in kentucky.

When Are Taxes Due In Kentucky 2024?

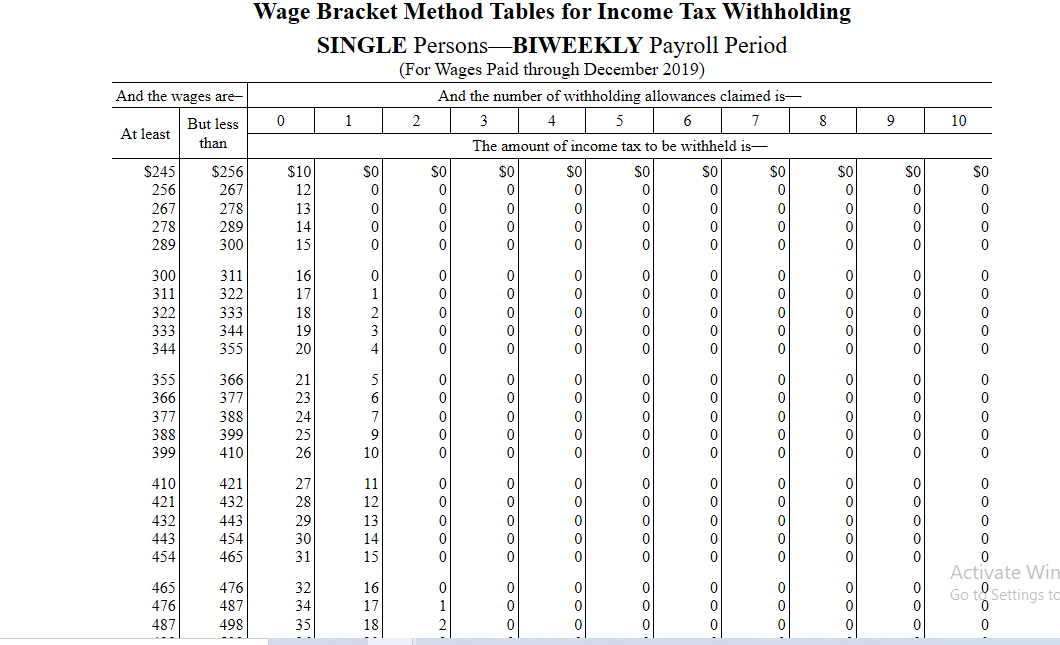

1) multiplying wages per pay period by.

1 Published Withholding Tax Tables And Computer Formula Information, Effective For Tax Years Beginning Jan.

Images References :

Source: www.withholdingform.com

Source: www.withholdingform.com

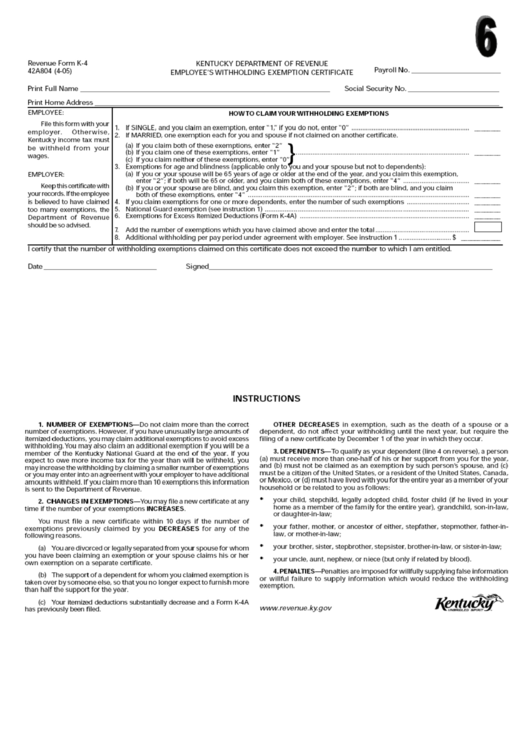

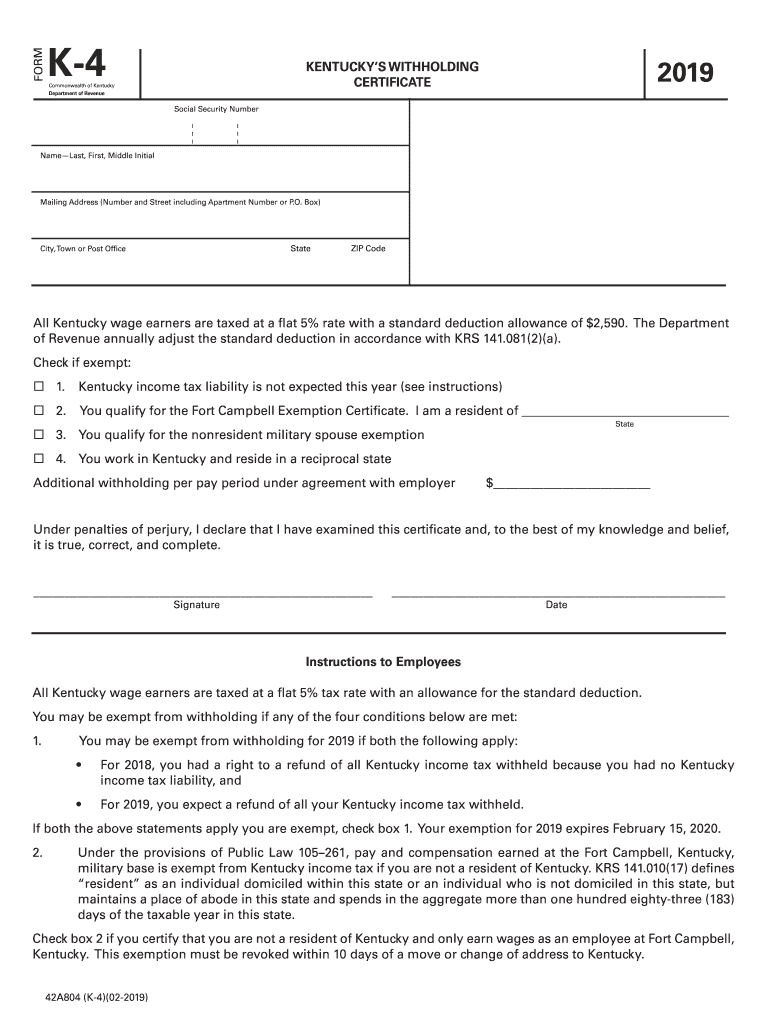

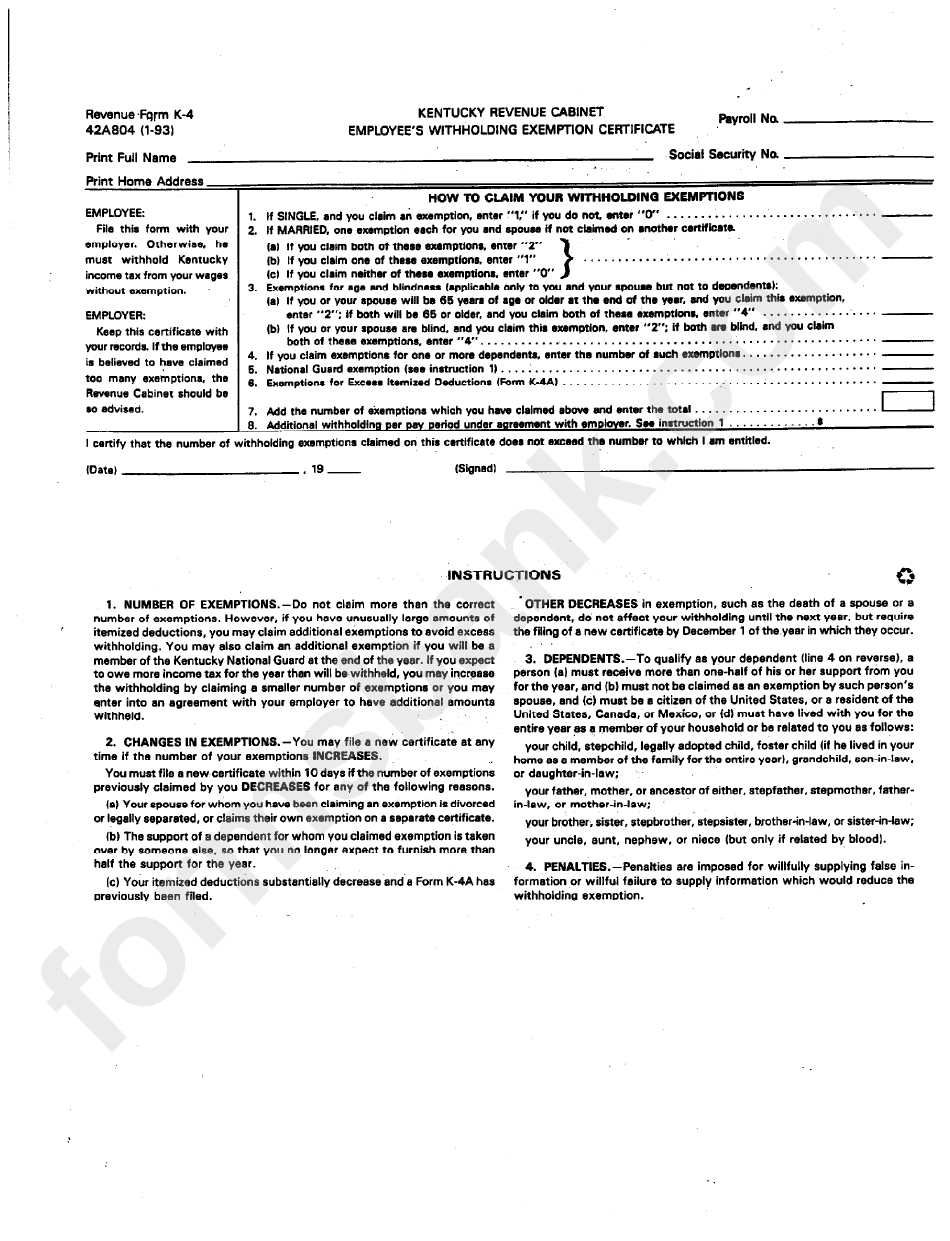

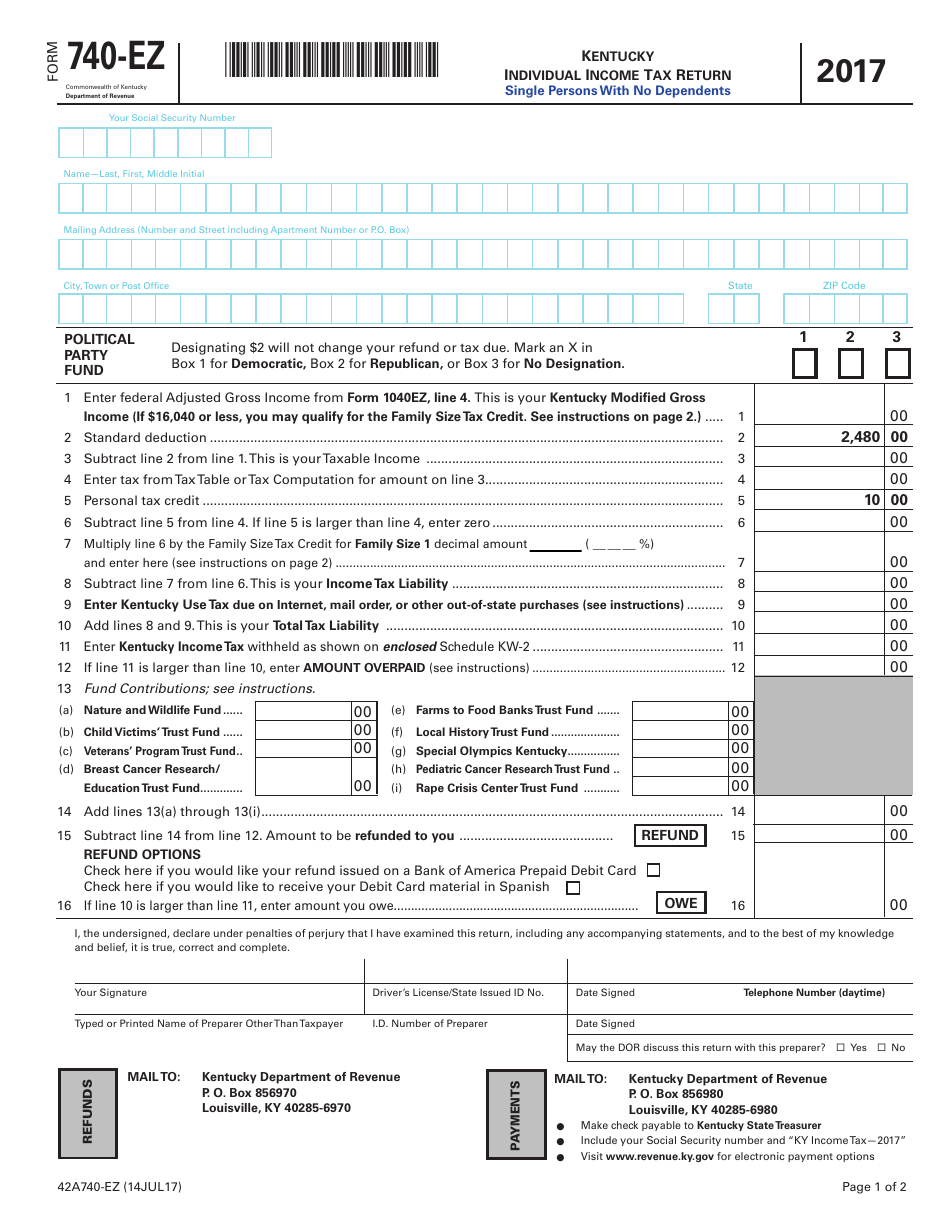

Ky State Tax Withholding Form, To estimate your tax return for 2024/25, please select. In addition to federal withholding, kentucky has its own state withholding rules.

Source: www.employeeform.net

Source: www.employeeform.net

Kentucky Employee State Withholding Form 2023, But i did find that the. This amount will be incorporated into 2024 tax forms and should be used for tax planning in the new year.

Source: printableformsfree.com

Source: printableformsfree.com

Kentucky Employee Withholding Form 2023 Printable Forms Free Online, Using the tax rate, the standard. The kentucky department of revenue sept.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form K4 Employee'S Withholding Exemption Certificate, Kentucky withholding is pretty straightforward to calculate using a formula provided by the state. Kentucky state income tax withholding.

Source: www.veche.info

Source: www.veche.info

Mississippi State Tax Withholding Form » Veche.info 16, Kentucky state income tax tables in 2024. Kentucky state income tax withholding.

Source: bestof-youx.blogspot.com

Source: bestof-youx.blogspot.com

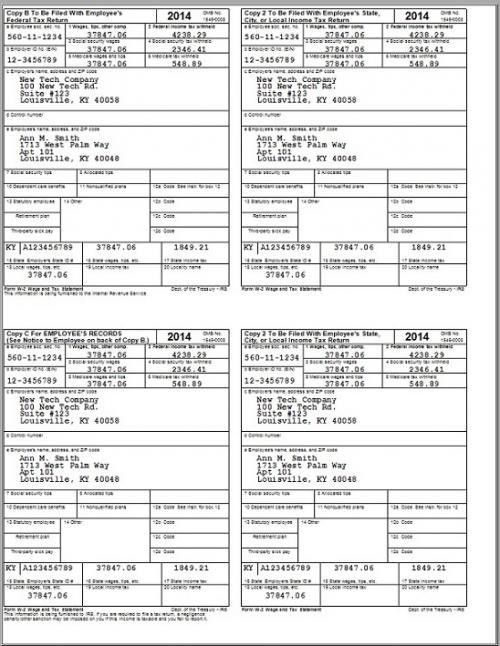

Bestof You Federal Tax Withholding 2022 In The World The Ultimate Guide!, In addition to federal withholding, kentucky has its own state withholding rules. The kentucky department of revenue dec.

Source: www.formsbank.com

Source: www.formsbank.com

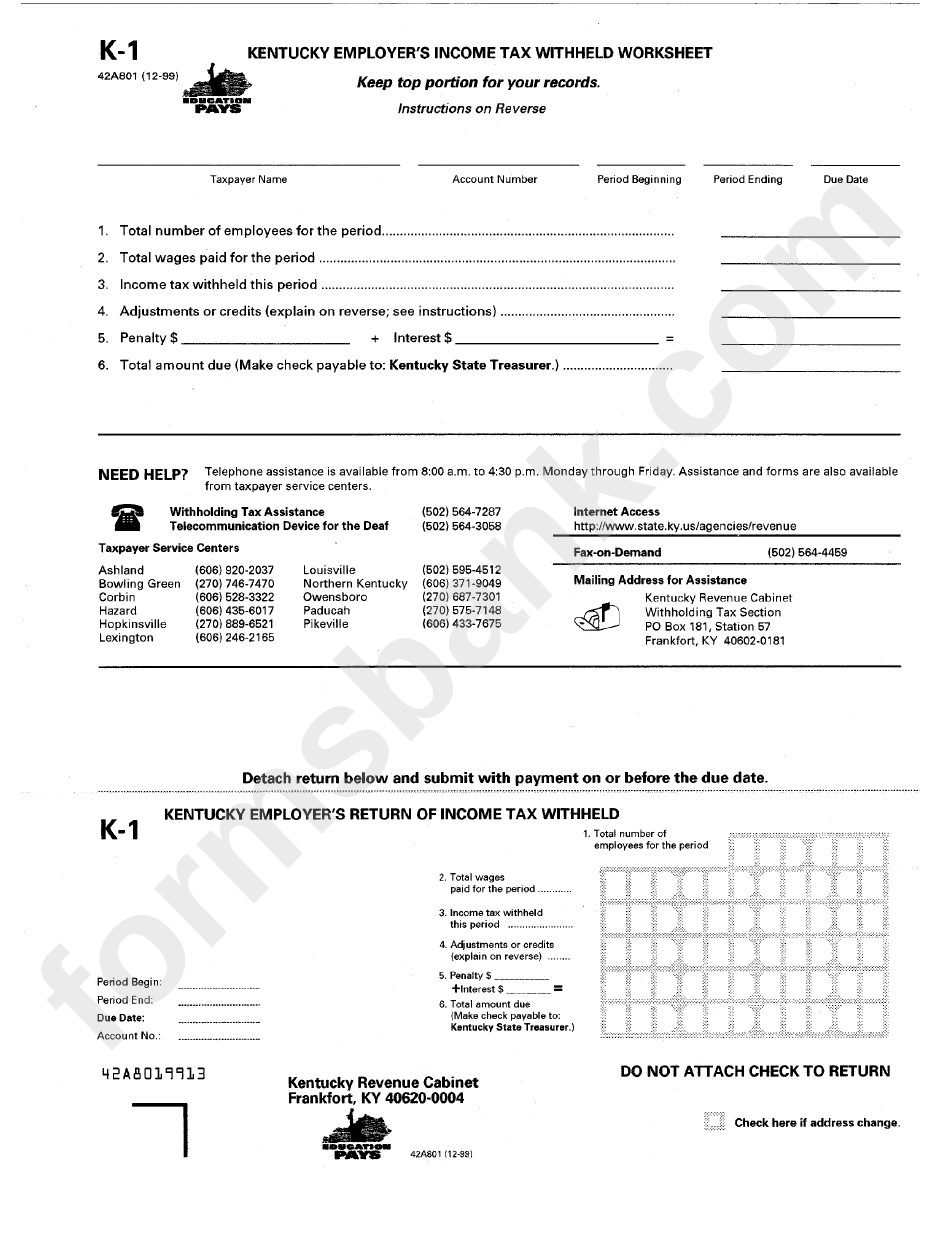

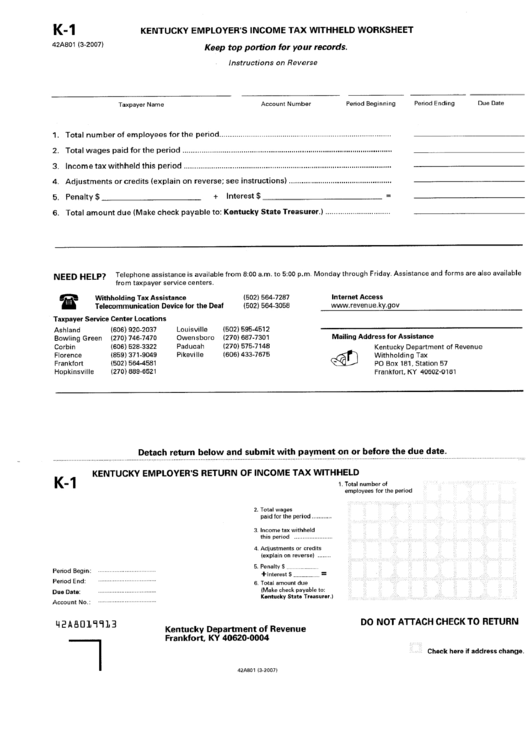

Form K1 Kentucky Employer'S Tax Withheld Worksheet printable, Kentucky state income tax withholding. The federal deadline is april 15.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

Printable Kentucky State Tax Forms, Kentucky withholding is pretty straightforward to calculate using a formula provided by the state. The individual income tax rate for 2024 has also been established to be.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

Printable Kentucky State Tax Forms, 1) multiplying wages per pay period by. The state income tax rate is 4.5 percent, and the standard deduction is $2,980 as of 2023.

Source: www.withholdingform.com

Source: www.withholdingform.com

2022 Ky State Withholding Form, 1 published revised withholding tax tables and the withholding tax computer formula, effective for the tax year beginning. The irs expects more than 128.7 million individual tax returns to be filed by that date,.

The Individual Income Tax Rate For 2024 Has Also Been Established To Be.

1) multiplying wages per pay period by.

The Kentucky Department Of Revenue Sept.

Using the tax rate, the standard.